Platinum Group Metals: The Investment Case for 2026

Platinum hits $2,684/oz as supply deficit deepens. PGMs face limited investment options and structural demand support through 2029.

- Both platinum and palladium are experiencing multi-year consecutive deficits, with platinum's 2025 shortfall of 692,000 ounces cutting above-ground stocks by 42% to less than five months of coverage.

- Hybrid vehicles (20% of global sales, fastest-growing segment) require 10-20% more PGMs per vehicle than traditional ICE vehicles, while the EU policy reversal on 2035 ICE bans extends demand runway.

- Only two major greenfield PGE mines are in development globally (Ivanhoe's Platreef and Tharisa's Karo), both in high-risk jurisdictions, as aging South African infrastructure continues to decline.

- Platinum surged 142% year-over-year to $2,684/oz, with producers like Valterra forecasting doubled profits, validating a new PGM bull market cycle.

- Approximately 90% of global PGE reserves are in South Africa and Russia, creating strategic value for new projects in stable jurisdictions like Brazil with streamlined trial mining regulations.

Why Platinum Group Metals Represent an Investment Opportunity in 2026

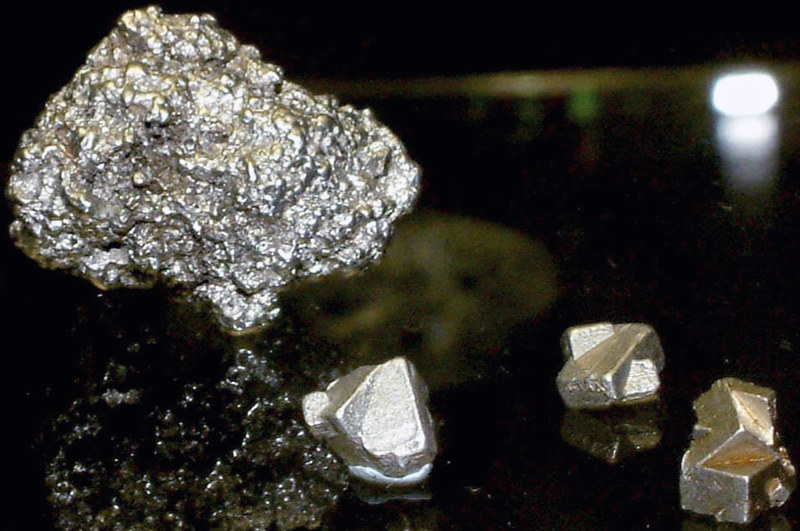

Platinum group metals have occupied an uncertain position in investor portfolios, too industrial to be pure precious metals plays, too supply-constrained to model with confidence, and too dependent on automotive demand to escape the electric vehicle narrative that dominated the 2020s. That perception is changing in 2026.

Platinum reaching $2,684 per ounce, up 142% year-over-year, represents more than a cyclical rally. It signals a repricing of assets combining scarcity with diversified demand drivers across automotive, industrial, jewelry, and investment sectors. Valterra Platinum's forecast of doubled annual profits demonstrates PGM producers are experiencing leveraged earnings growth.

South Africa's dominance in PGE production faces mounting challenges. Since 2016, several major platinum operations have closed or been suspended, including Bokoni and multiple shafts at the Marikana, Rustenburg, Kroondal, Kloof, and Beatrix complexes.

Nick Smart, CEO of ValOre Metals, contextualized this trend:

"Older mines particularly in South Africa - which become more and more challenging and costly to operate - have a drop off in terms of supply."

His background includes six years working in Anglo Platinum operations, providing firsthand perspective on operational difficulties facing the world's primary PGE producing region.

Most South African PGE deposits occur at depths of 600-800 meters underground, requiring massive infrastructure investment and long development timelines. Labor disputes, power supply challenges, and rising operating costs compound these difficulties. Mine supply has declined structurally despite stable demand, creating the foundation for the current deficit situation.

Platinum experienced a surplus of approximately 1,000 thousand ounces in 2022, but this reversed sharply. By 2023, the market showed a deficit of approximately 800 thousand ounces. This deficit has persisted through 2024 and 2025, with forecasts indicating continued deficits of 400-500 thousand ounces annually through 2029.

The 2025 shortfall of 692,000 ounces has reduced above-ground platinum stocks by 42%, leaving less than five months of consumption coverage. This represents a critical threshold: below six months of stocks, markets typically experience heightened price volatility and increased sensitivity to supply disruptions.

Palladium tells a similar story. After experiencing a significant surplus in 2023 (approximately 1,200 thousand ounces), the market shifted to deficit in 2024 and is forecast to show small surpluses or deficits in the 50-400 thousand ounce range through 2029. The volatility reflects tight supply-demand balances where minor shifts in automotive demand or recycling rates create market swings.

Demand Drivers: More Resilient Than Anticipated

The dominant narrative from 2018-2023 predicted declining PGM demand as battery electric vehicles displaced internal combustion engines. This forecast failed to anticipate three critical developments.

First, EV adoption has moderated from earlier projections. Global new vehicle sales in 2025 show 55% internal combustion engines, 20% hybrids, and 25% battery electric, not the 50%+ EV penetration earlier forecasts assumed. Major automakers including Ford, Honda, Volkswagen, and Porsche have scaled back EV plans. The U.S. eliminated federal EV incentives in September 2025. Second, hybrid vehicles have emerged as the fastest-growing category at 20% of sales. This matters for PGM demand because hybrids require 10-20% more PGMs per vehicle than traditional ICE vehicles. As Smart explained:

"Hybrid vehicles - because they are smaller engines and they run cooler, you've got to use more of the platinum and palladium in that auto catalyst."

The smaller, cooler-running engines in hybrids require more catalyst loading to achieve the same emissions performance. Third, regulatory shifts have extended the ICE vehicle timeline. The EU's delay or reversal of its 2035 ICE ban means autocatalyst demand will persist longer than the market had priced in during 2022-2023.

Autocatalysts account for approximately 40% of total platinum demand and approximately 80% of all palladium and rhodium demand. The sustained strength of this demand segment underpins the current structural deficit.

Record gold prices, up 115% year-over-year and exceeding $4,500 per ounce in some markets, have created an unexpected demand driver for platinum: jewelry substitution. Platinum's properties make it attractive for jewelry applications as a white metal with noble characteristics, hypoallergenic and durable.

Global jewelry production accounts for approximately 70 million ounces of gold versus approximately 2 million ounces of platinum annually. If even 1% of current gold jewelry demand switches to platinum, it would add 700,000 ounces of platinum demand, roughly equivalent to the current annual deficit.

China represents the primary growth market. Physical platinum demand grew from nearly zero in 2019 to over 400,000 ounces in 2025.

Platinum serves critical industrial functions in chemical processing and petroleum refining, providing demand stability less subject to economic cycles. Investment demand has increased during monetary uncertainty, with Federal Reserve rate cuts and inflation boosting precious metals interest.

Company Focus: ValOre Metals

ValOre's Pedra Branca Project in Ceará State, Brazil, encompasses 51,096 hectares with an 80-kilometer mineralization strike. The NI 43-101 inferred resource stands at 2.2 million ounces of platinum, palladium, and gold across 63.3 million tonnes grading 1.08 g/t, distributed across seven near-surface zones.

Two key advantages distinguish Pedra Branca: near-surface mineralization enabling opencast mining that reduces capital intensity and operating costs compared to South African mines at 600-800 meters depth, and higher-grade surface material allowing initial mining to target economic material. ValOre has invested CAD$10 million in exploration since 2019. Previous operators invested approximately USD$30 million.

ValOre's 2026 plan targets Q4 2026 publication of a Preliminary Economic Assessment, followed by licensing initiation in Q1 2027. The company targets trial mining license approval, enabling demonstration plant construction at one-tenth scale, potentially enabling H2 2028 production at approximately 15,000 ounces annually.

ValOre aims to become an integrated precious metals producer in Brazil, with near-term M&A targeting advanced-stage gold projects.

The strategy: acquire projects that completed trial mining licensing and proven metallurgy but lack capital for full production. This provides near-term cash flow, Brazilian permitting experience, and diversification. The CAD$30 million market cap values ValOre at approximately $12 per resource ounce, a discount to peers like Bravo Mining (approximately $53/oz) or Platinum Group Metals (approximately $19/oz).

ValOre benefits from experienced leadership. Nick Smart (CEO) brings 21 years with Anglo American and De Beers, specializing in design, construction, and commissioning including Scorpion Zinc in Namibia, six years with Anglo Platinum in Brazil, and diamond operations. Jim Paterson (Chairman) co-founded Discovery Group, participating in over $1 billion in M&A, with director roles at companies including Hathor Exploration (acquired by Rio Tinto for $650M), Kaminak Gold (Goldcorp for $520M), and Northern Empire (Coeur Mining for $117M).

For Investors

The platinum group metals sector has transitioned into a bull market. Platinum at $2,684/oz (up 142% year-over-year) and Valterra's doubled profit forecast validate the underlying fundamentals.

- PGMs represent a supply-constrained commodity with multiple demand drivers (automotive, industrial, jewelry, and investment), reducing single-sector risk while maintaining scarcity.

- Geographic concentration (90% in South Africa) and limited development pipeline create supply barriers even at elevated prices, suggesting persistent deficits through 2029.

- Development-stage companies advancing projects toward production offer leverage to both PGM price appreciation and project de-risking.

- Companies with near-surface deposits in alternative jurisdictions may command premiums given regulatory support for trial mining, infrastructure access, and political stability compared to South Africa and Russia.

- ValOre Metals: 2.2 million ounce resource in Brazil, trading at $12/oz versus peers at $19-53/oz, with near-term catalysts from PEA publication (Q4 2026) and M&A activity targeting gold production.

- PGM prices show significant volatility, with palladium trading above $3,000/oz in 2022 before declining to approximately $1,000/oz in 2024.

- Development-stage companies lack hedging, making equity values highly price-sensitive.

- Execution risk remains material. ValOre's Pedra Branca is early stage (inferred resource, pre-PEA) with multiple hurdles before production.

- Development companies require financing rounds, potentially causing dilution. ValOre held approximately CAD$0.8 million cash as of January 2026.

Investors should balance conviction with appropriate position sizing for development-stage mining investments. The fundamental case includes scarcity (approximately 6 million ounces annual platinum production versus gold's approximately 120 million), diversified demand, limited supply response, and sector transition. As producers like Valterra demonstrate margin expansion, development-stage companies with suitable assets in stable jurisdictions may benefit from this multi-year bull market.

TL;DR

Platinum reached $2,684/oz (up 142% YoY), driven by supply deficits of 692,000 ounces in 2025 cutting stocks by 42% to less than five months of coverage. Hybrid vehicles (20% of global sales) require 10-20% more PGMs than traditional cars, while the EU's reversal of 2035 ICE bans extends demand. Only two greenfield PGE mines are in development globally, both in high-risk jurisdictions, while South African infrastructure (90% of global reserves) continues declining. Valterra forecasts profits to double. Fewer than six public companies hold material PGE resources outside South Africa and Russia. ValOre Metals (CAD$26M market cap, 2.2M oz resource at $12/oz) trades at discount to peers like Bravo Mining ($53/oz), with Q4 2026 PEA and M&A strategy targeting near-term gold production.

FAQ's (AI-Generated)

Analyst's Notes

Subscribe to Our Channel

Stay Informed