Bonterra Resources (BTR) - Finally The Right CEO to Unlock Gold Project

Bonterra is a Canadian gold exploration company with a large balanced portfolio of exploration and mining assets inc Gladiator, Barry and Moroy deposits,

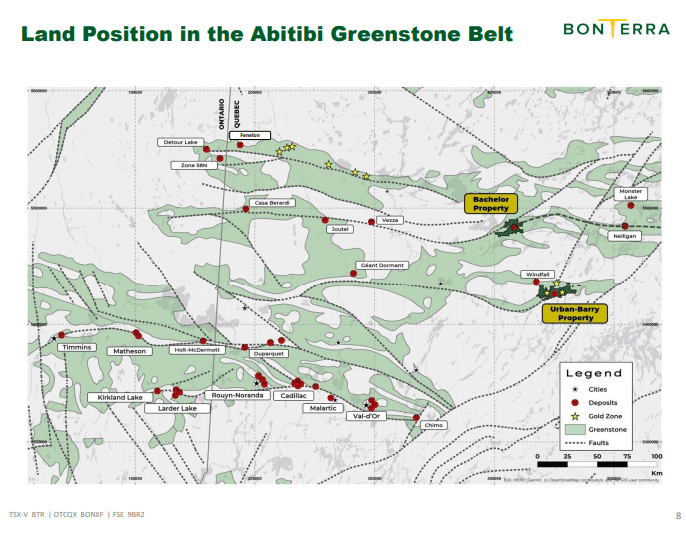

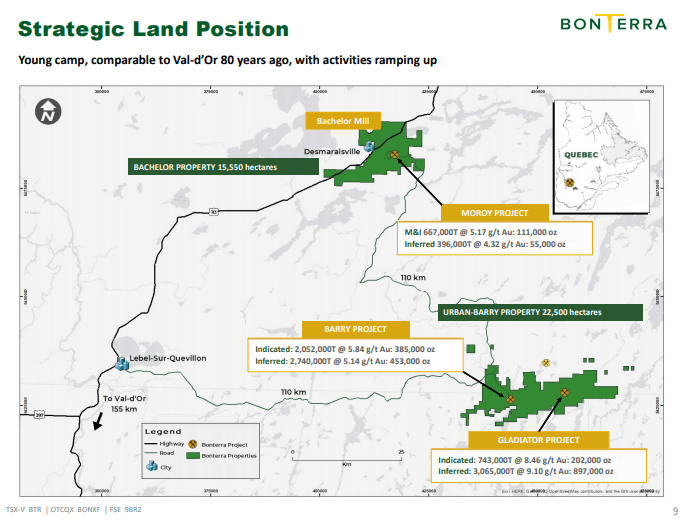

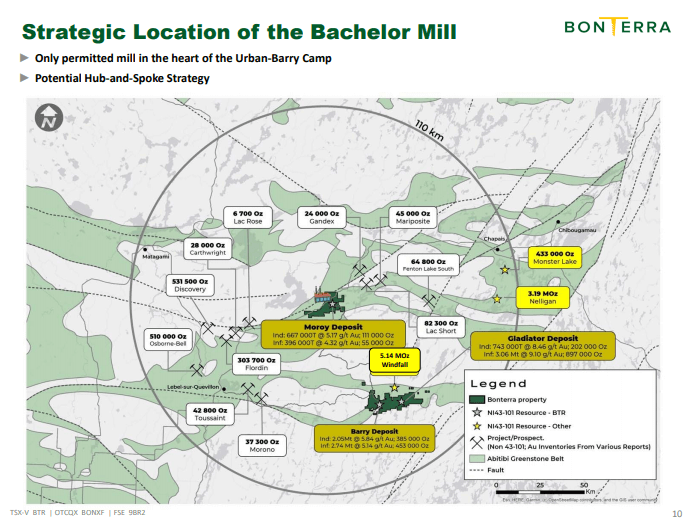

Bonterra is a Canadian gold exploration company with a large balanced portfolio of exploration and mining assets including the Gladiator, Barry and Moroy deposits, Urban-Barry Mill and multiple highly prospective exploration prospects. Bonterra controls the only permitted gold mill in the region with a large land position of over 38,000 hectares in the Urban Barry Camp. Bonterra is located in the mining-friendly province of Quebec, within the Abitibi Greenstone Belt.

We met with Pascal Hamelin, CEO of Bonterra Resources which is a new story for us.

What Happened to the Shares; Implementing Change

When we first heard of Bonterra, in mid-2017 the shares were over USD$6 but since then it's been in steady decline down to around USD$1.27 today. The Gladiator project initially had very good grades which originally attracted investors and created momentum. The company then delivered a NI 43-101 showing only 1.1Moz and as a result, the general investors were disappointed because they thought it was a 3Moz deposit. However, Bonterra is still early on in the process and has only drilled 100,000m at Gladiator so far and they are in a camp where there will be a lot of ounces.

When the company announced only 1.1Moz, Bonterra lost their credibility in the market, which is now being slowly regained. The assets are good and the grade is still there, so they need to drill it and deliver and eventually, then perhaps investors will return.

The previous management team at Bonterra has all gone now, and Pascal Hamelin has been brought in as the interim CEO and is now the full-time CEO at Bonterra. We like his candour and the simplicity of how he views the task ahead.

Timeline for Deliverables in 2021

Bonterra completed the 43-101 in 2019 but there were a lot of gaps with not enough drill density to even make the Inferred category. There are drill intercepts but they are far apart hence, Bonterra has been in-fill drilling since 2019 and throughout 2020. They're currently in the middle of a 63,000m drill campaign and by November-December they had drilled 23,000m so are on their way to complete the 63,000m before the end of April. They have started the mineral resource estimate and already have the consultant on board with the aim to deliver the mineral resource before the end of Q2/21.

Following the resource estimate, they already have the mining engineers working, so it won't take long to do the PEA which they hope to do by late Q3/early Q4 of 2021.

Bonterra has 8 drills, but currently in Northwest Quebec, the assay labs are swamped with assays and the diamond drilling companies are refusing jobs so there aren’t enough drillers available for work. Bonterra has 6 out of 8 drills running right now, but are focusing on what they can achieve. They have drilled 23,000m so far and will go back up to 8 drills as soon as they are able.

COVID-19 Impact & Restrictions in Country

The government enforced a total lockdown and curfew in early January following the Christmas break. Essential work can continue and a drilling campaign is considered essential work. Mining companies like Agnico Eagle and Kirkland Lake Gold are all in operation. The 15-minute tests are available now, so Bonterra is testing people coming on site and as the staff stay in camp for 7-days it is easier to control who is coming in and out.

Drill Results: Reported & Left to Report

Of the 63,000m drill programme, they have drilled 23,000m with over 15,000m reported to the market so far. The assay lab has a 4-week backlog, so they’re releasing news now from early December.

Cash Position since Raise

Bonterra raised about USD$15M just before Christmas and has about USD$14M cash currently. They are also selling Gold as they still have Gold inventory in the mill that they are cleaning out and have probably 1 more doré to pour in the next 3-4-weeks. They have had close to 1,800oz Gold in total with the inventory.

Bulk Samplings: Results, Process, Permits, & Time

Bonterra has another deposit, Barry where their predecessor extracted 600,000t out of the deposit between 2008-2010 so they know how the material behaved in the mill. They know the geology on the surface and now only need to extrapolate underground so don’t need a bulk sample at Barry. At Gladiator there's a lot more work to do on the permitting and there is no decline yet there. The deposit is on the floor of a lake so an environmental permit is required to do a bulk sample, or an open pit.

An environmental permit requires confirmation that the rock that will be extracted is not acid-generating and that the rock pile will not be generating acetic water drainage which takes about 18 months overall. Bonterra began in 2019 so they hope to get the permit in summer of 2021 to begin the decline at Gladiator. Then to get to 100m below the surface under the lake to do exploration takes about 1-year.

Relationship with Major Shareholders

Bonterra has a pool of significant shareholders who understand mining including Wexford, Van Acker, Kirkland Lake Gold, Eric Sprott. These shareholders understand that these successful mines don't happen overnight and they are very supportive of Bonterra. However, the generalists and new investors coming into the Gold sector are sometimes disappointed due to lack of mining experience.

State of the Mill

The mill is on the highway near the Bachelor mine, which is about 110km away from Gladiator and Barry. It's accessible through a year-round gravel road which is a class 1 road due to the forestry industry to enable over 1t trucks to travel on the roads. The mill was built in the 1980s and was at first a small narrow process and upgraded to 800tpd in 2008. It's capable of grinding 800tpd of material from Bachelor or 1,200t/day of the softer material from Barry. The mill is on care and maintenance currently but Bonterra are cleaning out the inventory and are in the permitting process to bring that to 2,400tpd, upgrading the grinding circuit, on the crushing circuit and the power line. The mill will be a straight carbon and bulk process. The best sorting is the cyanide process, which has been tested for 100-years.

Moments for Bonterra: Focus, Goals, & Expectations

Bonterra now has a good plan, they know their numbers and how much their assets are worth. Having a mill is a significant asset for when the company is ready to go into production. They are confident that the market will now see the company is busy drilling and releasing drill results with the imminent mineral resource estimate and then the PEA.

Bonterra has 35,000 acres of unexplored land with Gold showings all over it. Their current focus is on Gladiator and Barry, but they also have a brand new camp in Val d’Or where they have started regional drilling.

Bonterra is an interesting company with their 3 assets in the Abitibi greenstone belt. They already have a resource of 2.1Moz in the books and are currently in the middle of a 63,000m drill campaign. They are scheduled to deliver a mineral resource estimate before the end of Q2/21 which will be immediately followed by a PEA in Q3/Q4. They have good support from their shareholders and have good institutions behind them. They did a capital raise just before Christmas, so are cashed up to deliver. We are excited about Bonterra and interested to see how the story develops and will stay in touch to see if they can deliver those small steps between now and Q4/21 this year.

To Find out more, go to the Bonterra Resources website

Analyst's Notes

Subscribe to Our Channel

Stay Informed