Major Partnership Validates Ridgeline Minerals' CRD Discovery at Selena, with Fully Funded 2026 Exploration Across Polymetallic Projects

Ridgeline's Selena CRD discovery hits multiple massive sulphide horizons; South32 compares to US$2bn Taylor deposit whilst funding 100% of exploration costs.

- Ridgeline Minerals has discovered multiple massive sulphide horizons at its Selena project in Nevada, intersecting 17 metres of 6% zinc with 30-40 g/t silver plus copper, gold, and antimony credits, validating a 2-kilometre-long magnetotelluric anomaly that South32's Chief Development Officer has publicly compared to the early days of the company's Taylor deposit, which South32 acquired for US$2 billion and is spending US$3 billion to develop.

- South32 is funding of Selena exploration under an earn-in agreement requiring US$10 million over five years to earn 60% (with an optional phase two) automatically triggering Ridgeline's fully carried interest to commercial production on the remaining 20% stake worth a potential US$600 million in avoided dilution.

- The 17-metre intercept at Selena grades approximately 30% higher on a metal equivalent basis than the resource grade at Taylor, using metallurgical recovery rates of 79-95% from Taylor's feasibility study ticked boxes for validation despite the market's muted response to the polymetallic nature of the mineralisation.

- Ridgeline is targeting a 50-million-tonne system at Selena based on the scale and intensity of geophysical anomalies, currently testing the heart of the magnetotelluric target and results expected in early January 2026.

- The company anticipates approximately US$12 million in partner-funded exploration across its three Nevada projects in 2026, the largest budget in company history.

Nevada's carbonate replacement deposits represent some of the world's most valuable polymetallic ore bodies, yet they remain poorly understood by mainstream mining investors accustomed to simpler gold or copper stories. Ridgeline Minerals (TSXV:RDG) recently announced results from its Selena project that exemplify this challenge: technically impressive intercepts including 17 metres of 6% zinc with significant silver, copper, gold, and antimony credits. President and CEO Chad Peters argues that investors may be overlooking a discovery with genuine world-class potential.

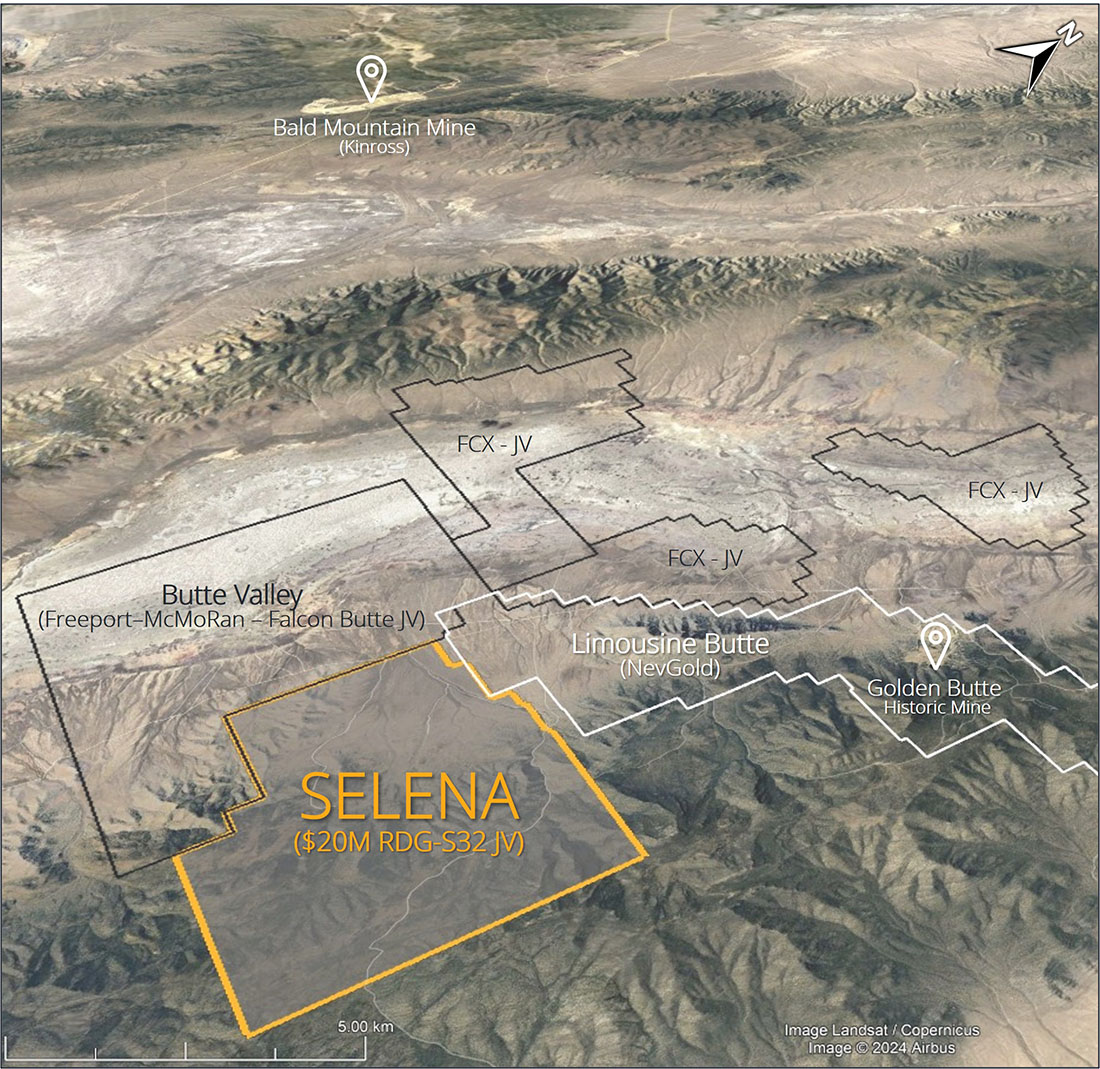

The Selena discovery represents a critical validation point for Ridgeline's business model, which centres on partner-funded exploration across three Nevada projects totalling US$60 million in committed expenditures. With South32 only 18 months into a five-year, US$10 million phase one earn-in at Selena, and Nevada Gold Mines advancing the Swift and Blackridge projects, Ridgeline offers investors leveraged exposure to significant discovery potential without the dilution typically associated with junior exploration programmes. Understanding what the company has actually discovered at Selena, and why South32 remains enthusiastic despite muted market response, becomes essential for assessing whether current valuations present opportunity or reflect fundamental concerns about the deposit's viability.

Selena Discovery: Decoding the Polymetallic Value

Ridgeline's second drill hole at the Chinchilla sulphide target within Selena intersected multiple massive sulphide horizons over a 500-metre vertical extent, with headline intercepts including one metre of 27% zinc, 60 g/t silver, 1.5 g/t gold, and 1.5% copper within a broader zone of 17 metres averaging 6% zinc with 30-40 g/t silver, plus 0.1% copper, 0.1% antimony, and 0.1 g/t gold.

Peters acknowledged that communicating the value proposition proved challenging:

"We're reporting on six different metals. Just to put in perspective, we average 0.1% antimony. Antimony is five times as valuable as copper. So that 0.1% antimony hit is the equivalent to seeing half a percent copper. Suddenly over 17 metres as a byproduct element that starts looking really valuable."

The company calculated metal equivalents using metallurgical recoveries from South32's Taylor deposit feasibility study, which demonstrate 79% to 95% recovery rates across all metals in sulphide CRD mineralisation. Peters emphasised this distinction from the oxide gold and silver mineralisation Ridgeline had previously discovered at surface:

"Oxide lead and zinc does not recover worth a darn in like a heap leach scenario. But you get it in sulphide which is our new discovery, we just hit that is actually sulphide minerals. If you look at the pictures of the PR, it's very obvious looks like Taylor metals type stuff. That stuff has excellent metallurgy."

On a metal equivalent basis, the 17-metre intercept grades approximately 30% higher than the resource grade at Taylor, according to Peters, providing a benchmark for what constitutes success in this deposit style. The CEO noted,

"For us, it ticked the boxes for South32. We're in similar depths to target. We see higher grades so far on our first hole. It doesn't mean it's the next Taylor deposit but if we're talking about what is a benchmark for a successful first hole, this was it."

Geological Model and System Scale

The discovery hole drilled into the southern edge of a 2-kilometre-long by 1.5-kilometre-wide magnetotelluric anomaly that Ridgeline and South32 identified through geophysical surveys in 2024. Peters explained the significance:

"The big question before we hit this discovery was okay we got this 2 kilometre long by a kilometre wide anomaly. Is it actually representing sulphide or is it something else? It unequivocally represents the sulphide, picking that up and we're hitting massive sulphide horizons which is why you get this big broad anomaly."

The scale and intensity of this geophysical signature closely matches South32's Taylor deposit, which the major miner acquired for US$2 billion in 2018 and is currently spending US$3 billion to bring into production as one of the world's largest silver-lead-zinc deposits. South32's Chief Development Officer publicly posted on LinkedIn congratulating Ridgeline on the discovery and comparing it to the early days of Taylor, lending external validation to the company's interpretation.

Peters outlined the geological controls governing mineralization distribution:

"That thrust fault where we hit that was the narrow but super high grade. And then bleeding off of that is all the chimneys which are more flat lying. And that's what we then drilled down through."

The system exhibits both vertical chimney-style mineralisation, which tends to be structurally controlled and high-grade, alongside laterally extensive manto-style horizons that can build substantial tonnage with 30-60 metre thicknesses.

Importantly, the first hole drilled into a high-temperature zone immediately adjacent to the Butte Valley porphyry system by Freeport-McMoRan, which serves as the heat and fluid source for the entire CRD system. This proximity explains the zinc-dominant metal assemblage in hole 53, with Peters expecting subsequent drilling further from the porphyry to encounter higher silver and copper grades as temperature and host rock chemistry vary.

"This is the first hole we've ever drilled where zinc outranks silver as the dominant metal assemblage. I don't think that is going to be every single hole moving forward," Peters stated. "I am confident that this still firmly remains a primary silver deposit. We're gonna get some incredible byproducts if you want to call it that as we keep drilling this off."

The company is targeting a 50-million-tonne-plus system based on analogues to similar CRD deposits and the scale of geophysical anomalies. With hole 54 currently drilling through the heart of the magnetotelluric anomaly from west to east in the same orientation as the discovery hole, Peters expressed confidence:

"We think there's a very high likelihood that we should drill into some significant mineralisation with this hole just based on the model."

Interview with Chad Peters, President & CEO of Ridgeline Minerals

The South32 Partnership

Perhaps the most compelling aspect of Ridgeline's Selena story lies not in any single drill intercept but in South32's demonstrable commitment to the project. The partnership structure requires South32 to spend US$10 million over five years to earn 60% of Selena, with Ridgeline earning 10% of every dollar spent during this phase. An optional phase two allows South32 to spend another US$10 million over three years to increase its stake to 80%, which automatically triggers Ridgeline's fully carried interest to commercial production on the remaining 20%.

Peters addressed the significance of this carry structure:

"Taylor to build is publicly announced US$3 billion. So what is our 20% free carry worth? US$600 million - that's US$600 million less of dilution to Ridgeline shareholders to see this go all the way to commercial production."

He added that even if South32 elects not to pursue the 80% option, stating

"If we own 40% of what might be a world-class CRD, we can fund that all day long. We can go get a loan. We can do what we need to do to participate in that partnership or we bring in a third party who wants to fund that minority stake."

The partnership eliminates near-term financing pressure that typically constrains junior explorers. Following the discovery announcement, Ridgeline's share price declined despite having appreciated nearly 90% over the preceding three months. Peters acknowledged this dynamic:

"Our stock went down. If my next step was we have to go raise money now at a depressed share price to go out and drill 10 more holes next year and prove to the market that it actually is what we think it is. That would be really hard for us. It'd be highly dilutive and it'd be a real grind. I don't have to do any of that. South32 is fired up."

The company is already planning 2026 drilling and a production water well, with South32 demonstrating long-term commitment to the project. Peters noted that they're only 18 months into a five-year phase one earn-in, contrasting this with the Swift project where Nevada Gold Mines is in year four of five and approaching the transition to joint venture.

"At Selena, we have a lot of spending ahead of us, multiple years to prove the validity of this discovery and really get people excited before we even have to start thinking about potentially funding it ourselves," Peters explained.

Broader Portfolio and 2026 Outlook

Beyond Selena, Ridgeline maintains partner-funded exploration at Swift and Black Ridge with Nevada Gold Mines. The 2025 budget across all three projects totalled $9.5 million, with Swift receiving approximately $5 million for a planned five-hole programme. Laboratory capacity constraints at Nevada Gold Mines, which is prioritizing its massive Fourmile project, have delayed assay results from Swift's first two holes. Peters indicated results should be released within weeks, with drilling resuming in April 2026.

For 2026, Ridgeline anticipates approximately $12 million in partner-funded exploration across Swift and Selena, representing the largest budget in company history. The company reports warrant exercises providing additional working capital whilst requiring no equity financing to advance its core projects. This financial positioning allows management to remain selective and patient as discoveries mature, avoiding the dilution-driven financing cycles that often punish junior exploration companies following initial discoveries.

The Investment Thesis for Ridgeline Minerals

- Partner Validation Reduces Technical Risk: South32's Chief Development Officer has publicly compared Selena to the early days of the Taylor deposit (US$2 billion acquisition, US$3 billion development cost), providing external validation from major miners with extensive CRD expertise. Investors should monitor whether South32 accelerates spending or exercises the phase two option to earn 80%, which would represent the strongest possible signal of deposit quality.

- Financial De-risking Through Carry Structure: The potential for a fully carried 20% interest to commercial production represents US$600 million in avoided dilution if Selena reaches development, fundamentally changing the risk-reward profile compared to typical junior explorers. Investors should calculate the net present value of this carry at various discount rates and production scenarios to assess whether current valuations adequately reflect this optionality.

- Portfolio Diversification Across Multiple Funded Projects: With US$60 million in total partner commitments across three Nevada projects and an anticipated US$12 million budget in 2026, Ridgeline offers diversified discovery exposure without financing risk. Investors should track drill results from Swift and Blackridge alongside Selena to assess whether the portfolio approach is generating sufficient discovery frequency to justify the business model.

- Early-Stage Discovery Leverage: At approximately 10 holes required to define geometry across the 2-kilometre Selena anomaly, with only one discovery hole completed to date, the project sits at maximum exploration leverage where each subsequent hole materially impacts valuation. Investors with appropriate risk tolerance should consider accumulating positions ahead of hole 54 results (expected January 2026) and the 2026 drill programme commencement.

- Polymetallic Complexity Creates Information Arbitrage: The market's difficulty in valuing polymetallic CRD deposits, as evidenced by the muted response to technically strong drill results, may create opportunities for investors capable of conducting independent metallurgical and economic analysis. Investors should examine feasibility studies from Taylor, Hermosa, and I80's Hilltop to develop comparable metal equivalent frameworks for evaluating future Selena results.

Conclusion

Ridgeline Minerals presents an unconventional value proposition for mining investors. The company has made a discovery that its major mining partner explicitly compares to a US$2 billion acquisition now requiring US$3 billion in capital to develop, yet the market response has been tepid at best. This disconnect reflects either a fundamental misunderstanding of polymetallic CRD deposit economics, justifiable scepticism about whether a junior explorer's first hole into a large target truly represents world-class potential, or some combination of both.

What appears indisputable is that South32, a major miner with extensive CRD experience including ownership of Taylor, views Selena as sufficiently prospective to commit substantial capital whilst Ridgeline's share price languishes. For investors capable of evaluating technical merit beyond simple gold or copper intercepts, and willing to accept the timeline required to prove out a 50-million-tonne system through systematic drilling, current valuations may present opportunity. The alternative interpretation holds that market participants correctly assess the substantial execution risk inherent in translating one successful drill hole into a viable mining operation, particularly for a polymetallic deposit requiring complex metallurgy and significant infrastructure investment.

The next six months will prove instructive: results from drill hole 54, which is testing the core of the magnetotelluric target, alongside pending assays from the Swift project and resumption of drilling across the portfolio in early 2026, should provide investors with substantially more information to evaluate South32's confidence and Ridgeline's current market capitalization to appropriately reflect the probabilistic value of its discoveries.

Macro Thematic Analysis

Carbonate replacement deposits represent a critical supply source for multiple metals essential to energy transition and traditional industrial applications, yet they remain significantly underexplored relative to their economic potential. The polymetallic nature of CRDs - typically containing zinc, lead, silver, copper, and gold in varying proportions - provides natural hedge characteristics against single-commodity price volatility whilst offering exposure to metals with divergent demand drivers.

Silver demand continues structuring around solar photovoltaic applications, with the Silver Institute projecting industrial demand to exceed 700 million ounces annually by 2030, whilst zinc supply faces structural deficits as major operations including Century, Lisheen, and Glencore's various assets reach end-of-life. The concentration of remaining zinc production in politically sensitive jurisdictions including China, Peru, and Russia heightens supply chain security concerns for Western industrial consumers, creating strategic value for new Nevada-based discoveries.

The United States Geological Survey designates antimony as a critical mineral with import reliance exceeding 80%, primarily from China which has recently imposed export restrictions. Peters' observation that antimony is five times as valuable as copper highlights how supposedly minor byproduct credits in polymetallic systems can materially impact project economics, particularly as geopolitical tensions drive reshoring of critical mineral supply chains.

For investors, CRD-focused explorers offer asymmetric exposure to a deposit type that, whilst technically complex and challenging to communicate, generates world-class ore bodies when discovered. The key quote capturing this opportunity comes from Ridgeline Minerals' President and CEO Chad Peters:

"These CRDs actually, they're hard to find, but when you do, they're incredibly valuable because the metallurgy on these is really, really good."

South32's US$5 billion combined acquisition and development commitment to Taylor demonstrates that major miners are willing to deploy significant capital to secure long-life CRD assets in stable jurisdictions. The company's public comparison of Selena to early-stage Taylor suggests it views Nevada's carbonate replacement province as globally significant, not merely a regional exploration play.

TL;DR

Ridgeline Minerals has made a significant carbonate replacement deposit discovery at its Selena project in Nevada, with drill results including 17 metres of 6% zinc plus silver, copper, gold, and antimony credits that grade 30% higher on a metal equivalent basis than South32's Taylor deposit resource grade. South32, which acquired Taylor for US$2 billion and is spending US$3 billion to develop it, is funding 100% of Selena exploration under an earn-in agreement that could deliver Ridgeline shareholders a fully carried 20% interest to production worth US$600 million in avoided dilution. Despite technically strong results validating a 2-kilometre geophysical anomaly comparable in scale to Taylor, the market response has been muted, creating a potential disconnect between South32's demonstrable commitment and current valuations.

Testing the heart of the target with results expected January next year, pending Swift project assays, and a US$12 million partner-funded 2026 budget requiring zero shareholder dilution, Ridgeline offers leveraged exposure to multiple Nevada discoveries at maximum exploration leverage. The investment thesis centres on whether South32's validation signals world-class potential that the market has failed to recognise, or whether scepticism about translating one drill hole into a viable polymetallic mining operation is justified.

Frequently Asked Questions (FAQs) AI-Generated

Analyst's Notes

Subscribe to Our Channel

Stay Informed