ValOre Metals (VO) - Uranium Focus Excites Investors

Interview with Jim Paterson, CEO of ValOre Metals

ValOre Metals Corp. is driven to propel society forward through the discovery, exploration, and advancement of metals and mining projects around the world. Backed by a team of industry experts and an impressive track record of exploration, project development, and M&A (Mergers and Acquisitions) success, the company's goal is to add significant value to metals and mining projects globally.

Matt Gordon caught up with Jim Paterson, Chairman, and CEO, ValOre Metals. Jim is a principal of Discovery Group and has been actively involved in marketing and corporate development activities for the group companies since 2002. He has over 2 decades of industry experience which includes capital raises, acquisitions, joint ventures, spin-outs, RTOs, and IPOs.

He was the driving force behind over $60M in equity financing for ValOre Metals, leading to multiple discoveries and a 200% increase in mineral resources at the company's Angilak uranium project. Jim previously served as the Director at Kaminak Gold Corp. and the Founding Director of Northern Empire Resources Corp. He currently serves as a Director at Great Bear Royalties Corp., and a Strategic Advisor for Great Bear Resources Ltd., Genesis Metals Corp., Kodiak Copper Corp., and Ethos Gold Corp.

Company Overview

ValOre Metals' purpose is rooted in the drive to move society forward through the discovery and advancement of feasible metals and mining projects. The company was founded in 2008 and is headquartered in Vancouver, Canada. It is listed on the Toronto Stock Exchange (TSX-V: VO).

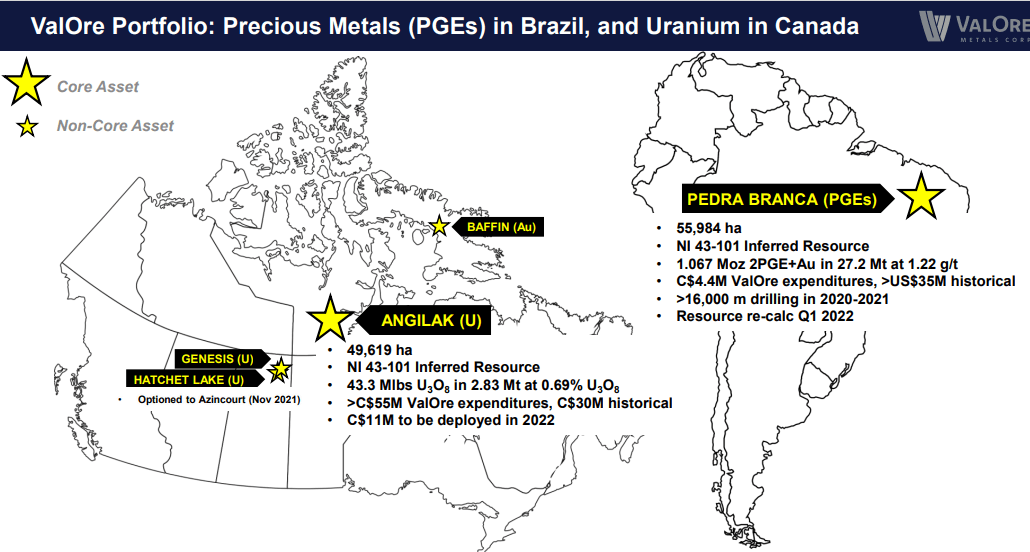

ValOre Metals is an explorer with a current market cap of CAD$70M. It has a project in Brazil called the Pedra Branca, a palladium-platinum project and a uranium project in Northern Canada called the Angilak Uranium Project. The company is a member of Discovery Group.

Pedra Branca District

ValOre Metals published a press release on 2nd September 2021, highlighting the discovery of big, broad intervals of mineralization along with high-grade sections at the Trapia deposit. Trapia will be included in the revised resource estimate that is scheduled for release in Q1 2022.

The company made significant discoveries at the Trapia, Santo Amaro, and Esbarro deposits, leading to the appreciation in value, and liquidity for the company. It is looking to demonstrate the growth potential of its resource. The company has carried out drill operations for the past 2 years and the inclusion of an inferred resource in Q1 2022 will provide the company with a significant jump in the resource.

As promised by the company, it drilled the 2 well-defined bodies at Esbarro and Curiu deposits. These deposits are near-surface, flatline shallow bodies that are well-mineralized. The deposits were drilled by the previous operators and ValOre Metals carried out definition drilling along with metallurgical work, leading to 77m of 3g from the surface in platinum and palladium at Esbarro. This deposit also featured 6.5m of over 0.5oz high-grade reserves.

ValOre Metals has plans to carry out cost-effective operations at the Pedra Branca district in 2022. The company's inferred resource will demonstrate the team's effective pursuits in growing the inferred palladium-platinum resources. The company plans to publish a PEA (Preliminary Economic Assessment) at this asset along with value-added resources, continued drill operations, and new discoveries.

Earlier in 2021, ValOre Metals raised $9M for Pedra Branca with an additional capital raise planned in 2022. The company is currently advancing the project and making discoveries, although the drill program is progressing at a slower pace than expected.

The company plans to push an inferred resource by Q1 2022 that will showcase the drill operations carried out in the past 2 years, leading to a significant value-addition to the project. The company is looking to highlight the presence of near-surface, broad sections of mineralization featuring high-grade reserves.

The Pedra Branca deposit also features low-grade nickel reserves. However, the company is focused mainly on the palladium-platinum reserves.

Exploration Findings

ValOre Metals carried out exploration at C4, Santo Amaro South, Trapia South, and Massape deposits. The exploration program in its entirety cost $3M less than the overall capital expended by the company. It is currently awaiting the assay results for the Massape deposit which currently has 10 drill holes. The Massape deposit will be added to the company's inferred resource. The assay results are expected in December 2021.

Santo Amaro South is located 2km from the main Santo Amaro deposit and is part of the company's inferred resource. The company carried out Trado drilling at this deposit along with trenching, RC drilling, and core drilling. The company plans to continue drilling at this deposit.

At the Santo Amaro deposit, the company uncovered 127m of under 1g and 53m of 2g. The company also found high-grade reserves at 127m of 0.85g by stepping out from the existing resource. ValOre Metals plans to deliver results on the Pedra Branca project by the end of 2022.

Capital Raise

In 2021, ValOre Metals raised in capital CAD$11M by way of flow-through funds. The company was originally looking to raise CAD$7M, however, the financing was oversubscribed leading to an CAD$11M raise. Over the course of its history, the company has raised CAD$76M in capital.

Flow-through funds enable investors to get tax breaks from the government of Canada. However, the capital raised can only be spent on carrying out exploration within the country. The company plans to utilize this capital for exploration activities at the Angilak uranium project in the territory of Nunavut.

A major factor responsible for the increased interest in the uranium market was the establishment of SPUT (Sprott Physical Uranium Trust) earlier in 2021, leading to a jump in uranium spot pricing.

ValOre Metals' Angilak uranium project is one of the most promising uranium projects globally. This project has attracted significant interest from retail investors. The company is looking to attract additional institutional investors.

The Angilak project has been under care and maintenance since 2013. The company is currently focused on its PGE (Platinum Group Elements) assets and plans to time the market when it comes to uranium. ValOre Metals is considering spinning out the uranium assets or diversifying its palladium asset into a new company. However, a final decision is yet to be made.

The company was approached by investors for a capital raise. The company has previously spent over $55M on the Angelik project and was planning to raise another $10M-$15M for an exploration program. However, a raise that is too high can lead to a slowdown in operations due to logistics and other unforeseen challenges. Additionally, the operation restrictions due to harsh weather conditions in the northern territories of Canada pose their own challenges. The company ended up raising the right amount of capital to prevent over-dilution while also setting realistic exploration targets. The capital raise will enable the company to carry out an extensive exploration program at the Angilak uranium project for 2022.

The Angilak Uranium Project

The Angilak Uranium Project features a 43Mlb resource. The company is currently looking to obtain the necessary permits and hire contractors to deliver the project. The company plans to carry out resource expansion, similar to its Brazil asset.

The company is looking to increase the resource from 1 or more of the 5 zones at the Angilak asset. The current 43Mlbs resource is based on 1 of the 5 zones, called the Lac 50 trend.

The company recently published a press release highlighting resource expansion at the J4 zone. It plans to step west from the existing J3 resource, drilling holes in a conductor that runs on previous drill operations.

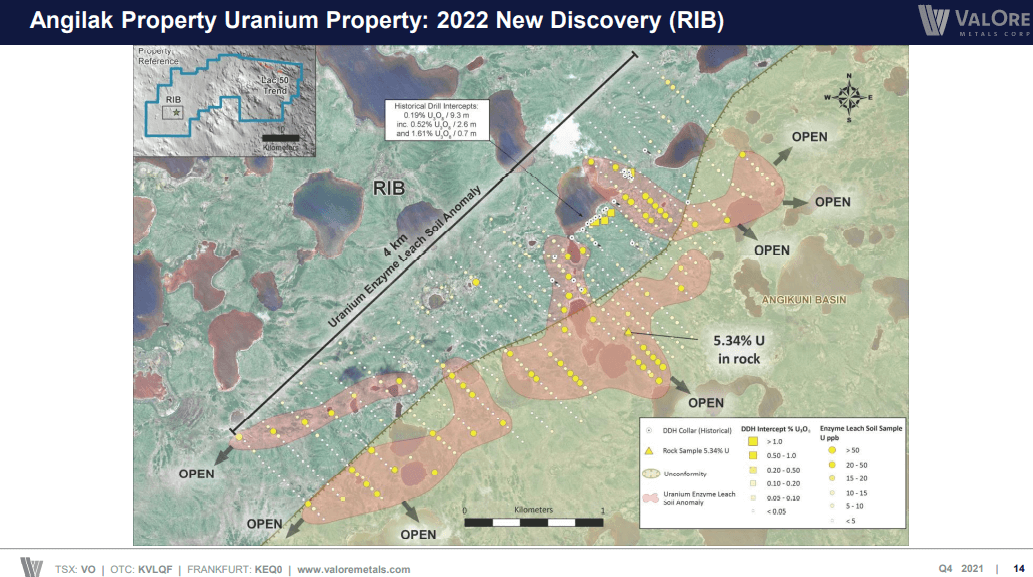

The press release highlights an area called RIB, a multi-kilometer uranium reserve in soil anomaly located within the basin. This region has had historical drilling in the 1970s by the Noranda group. The area features exactly the same mineralization as the company's resource located 35km away. The company is currently testing out this region and plans to invest significant capital towards logistics, fuel, and core drilling.

The Lac 50 zone features over 7 areas where the company has employed a core rig along the existing structures. The company has drilled and hit the uranium core which appears to be similar to the area that hosts the main resource. It is carrying out additional testing to attain density within the area, which will enable the inclusion of the resource into the inferred category.

The company plans to fine-tune these zones to move them into the resource category, this process is being labeled as target advancement. Following this, the company plans to carry out Greenfield discovery-type work at the asset.

Plans 2021 and Beyond

ValOre Metals plans to eventually spin out its Palladium-Platinum or uranium assets into a separate company. This would require an incentivized board and management team along with the backing of an investor group. This move is planned once the company has a better evaluation for its uranium asset.

ESG Component

ValOre Metals' Angilak Uranium Project is situated in Nunavut. The company has forged a strong partnership with the Inuits of Nunavut, specifically the NTI (Nunavut Tunngavik Inc.). Nunavut was one of the first areas in the world to have a uranium exploration policy. This policy enforced certain rules around uranium exploration within the region. The majority of the company's zones, discoveries are present with the Lac 50 trend. This zone is situated on Inuit-owned land.

Rob Carpenter, Founder, ValOre Metals negotiated a deal with NTI for reciprocity in the early years of the company. This deal enabled the company to extend the Inuit-owned land onto federal claims.

NTI is the largest landholder in North America and this deal allowed the company to collaborate with sophisticated resource administrations and knowledgeable resource practitioners. The company is currently planning out the drill operations for summer 2022. This will provide the company with sufficient time to obtain the required permits.

ETF Considerations

ValOre Metals plans to restart operations at its Angilak uranium project in the near future. Following this, the company plans to enter the uranium ETF (Exchange Traded Fund) market once it qualifies for trading.

To find out more, go to the ValOre Metals Website

Analyst's Notes

Subscribe to Our Channel

Stay Informed