Palladium One (PDM) - Glencore Investment Bolsters Copper-Nickel Projects for the Electric Future

Interview with Derrick Weyrauch, President & CEO of Palladium One Mining (TSXV: PDM).

Company overview

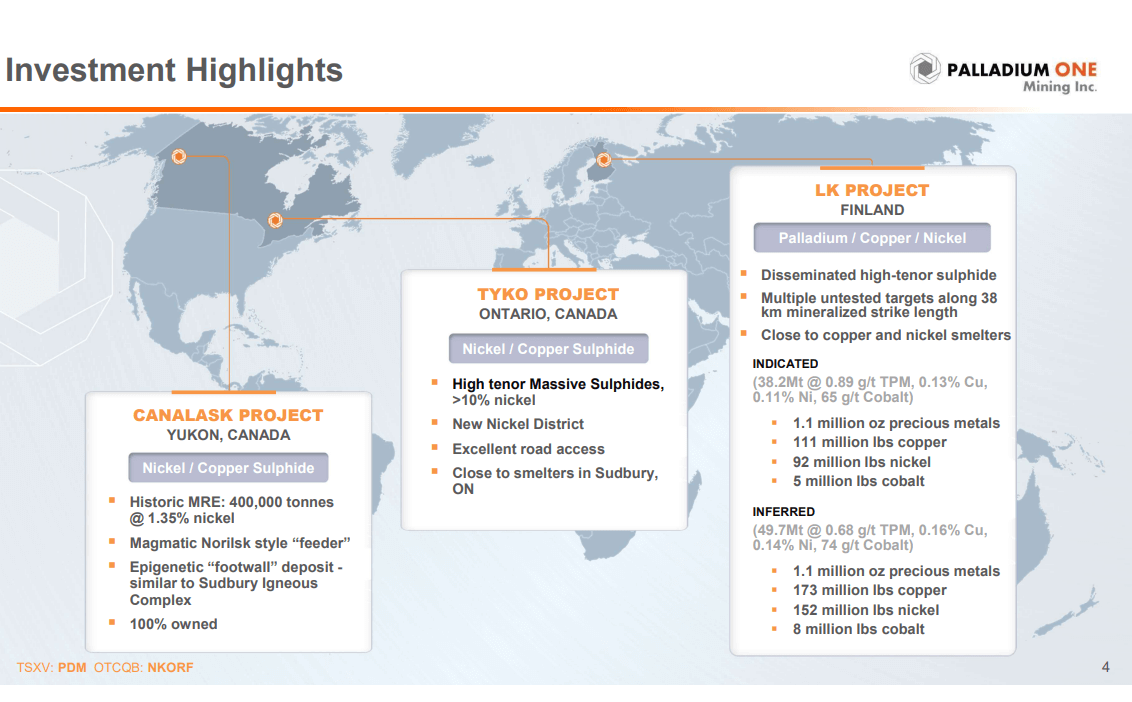

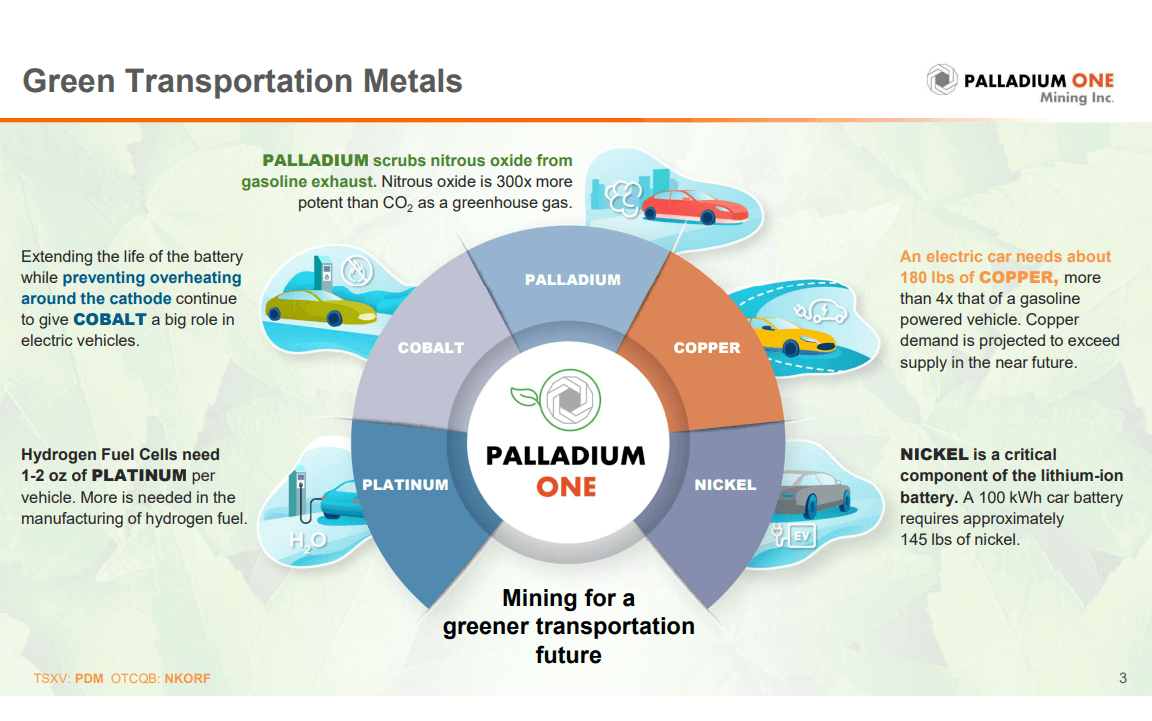

Palladium One Mining is a mineral exploration company focused on developing copper-nickel projects to support the growing demand for battery metals in the electric vehicle (EV) industry. The company's primary operations are located in Finland and Alaska, where they have discovered a significant resource, spanning over 30,000 hectares of greenfield property.

Overview of Glencore’s investment in Palladium One

Recently, Crux Investor conducted an interview with Palladium One Mining, revealing Glencore's equity investment in the company as a response to the US government's mandate to have two-thirds of vehicles electric by 2032. This mandate is driving industry and investment into the EV space, causing major players like Glencore to invest in exploration-stage companies with copper-nickel assets. Major companies are now seeking sources of supply to meet the growing demand for battery metals.

Palladium One's large-scale project portfolio attracted Glencore's attention. In addition to the equity investment, Glencore will contribute technical and infrastructure support. To maintain a 7% interest and rights in the project, a technical committee was formed, emphasizing the positive trend of government involvement and incentives.

Palladium One plans and budget allocation

Palladium One is focusing on refining targets through soil sampling before drilling, acquiring an XRF machine for quick soil identification, and allocating new capital for nickel exploration in Finland and Alaska[09:10]. The Glencore investment adds $4.2M in cash, and combined with the Metalcorp acquisition, the pro forma cash balance is $17.5M. This places the company in a strong position, with a long runway and plans to de-risk projects before tapping into Glencore's investment.

Possibility of non-dilutive capital raise

With non-dilutionary cash-raising options available, the company is not actively working on these and is instead focused on closing the Metalcorp transaction, Tyko, and Canalask. The company has enough banked-up assessment credits for at least 10 years and is well-equipped to handle future options.

Perspective on the current market environment

Now is the time to position oneself in mineral projects, as contrarian investors can make money by getting in at these valuations. Metal prices are expected to rise dramatically when the turn happens, and teams with a proven ability to advance projects will stand out in the long term.

To find out more, go to the Palladium One website

Analyst's Notes

Subscribe to Our Channel

Stay Informed